How Does DeFi Market Making Work? – In the past few years, we have seen an enormous growth in the decentralized finance industry. One of the most fundamental innovations that has occurred is the introduction of Automated Market Makers. These market makers pool liquidity and make it easy for traders to buy and sell assets. AMMs are used on many different exchanges.

Currently, the total market cap of DeFi exceeds $80 billion. This makes it the most profitable financial market on the planet. It is fuel by the demand for tokens and a thriving community of investors. But how does DeFi market making work?

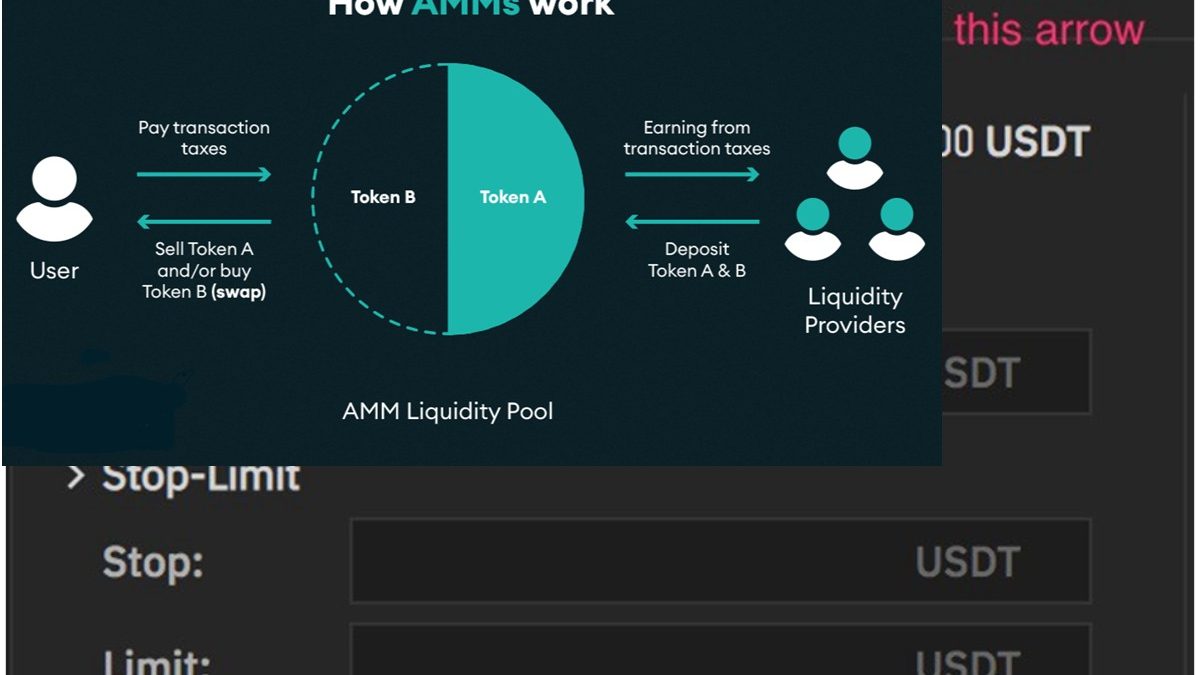

An automated market maker is a smart contract that allows people to trade without intermediaries. Instead of having to manually fill an order, you will be given an instant price quote, based on the pricing algorithm of the protocol. The price quote is based on a set of conditions, such as the number of shares, the price at which an asset can be bought, and the number of shares at which it can be sold. You can then deposit your Token A in a liquidity pool and receive 50% of the profits from the market making.

In the beginning, DeFi had a lot of trouble providing market making. Many assets were not yet available on the platform. Moreover, there was no pre-market trading. Having market making would have helped to cut down on some of the transaction costs. So, the developer team looked into introducing a solution. However, this was a major problem. They needed to implement a system that would automate the process.

One of the most popular solutions for securing liquidity is through an off-chain order book. With this mechanic, traders can avoid the costly and time-consuming process of getting an order place. Another method involves staking tokens. Those who stake tokens are reward with compound interest.

As with any other market, the competition for liquidity is organic and helps to make the markets liquid. The competition among market makers makes the system more efficient. Most professional market makers did not ramp up on DeFi stuff until recently.

While there are many different types of automated market makers, their mechanics are surprisingly similar. Some of them utilize Meta-Transactions to match orders. Others use Layer-2 tech. No matter which mechanic is use, it helps to increase efficiency. For instance, the Opium Protocol uses meta-transactions to match orders. Other platforms like dY/dX and 0x use similar mechanics.

Similarly, the Duck Liquidity Pool offers a DeFi market making protocol that uses a one-sided Token Burn to burn 50% of the provided Liquidity. Lastly, the Duck Liquidity Pool also offers customised NFT campaigns to earn high expected APY levels. And if that isn’t enough, you can also airdrop incubated project tokens.

Ultimately, while a market maker’s contribution can be substantial, the most powerful effect of their service is their ability to earn lucrative returns. This is why DeFi has become so popular. Not only does it allow traders to earn compound interest, but it also provides them with the opportunity to participate in new opportunities.