Quick Introduction to Unsecured Business Loans

Unsecured Business Loans – When people think of loans, the conventional definition that comes to mind is borrowing money to make a significant purchase, like a mortgage or car loan. However, remember that many financial institutions also offer unsecured business loans. Banks provide these loans after people have gone through a lengthy approval period, and the repayment is tense to collateral. contact@newcomputerworld.com

If you need cash for an unexpected business expense, this type of loan will benefit your business. Also, don’t come with stringent paperwork, doesn’t need a specific purpose, and doesn’t require anything more than excellent credit history. Take a look at this short manual to see how this type of loan works.

Unsecured Business Loans

When most entrepreneurs take out a loan, the funds received it secured by an asset. However, the mechanics become more complex when you need cash for your business expansion. In this case, the lender will ask you to provide another property as collateral. It could be your home, other real estate, vehicles, etc.

In contrast, unsecured or unsecured business loans do not require you to provide collateral. You can get this loan based on the credit history of the following:

The company itself

The business owner

All partners are involved in running the business.

As a borrower, you can obtain total financing by simply providing your name and signature. When analyzing the situation, the lender is taking a high risk because he cannot get his money back directly if the borrower cannot pay the loan terms. For this reason, other people call this unsecured business loan a signature loan.

However, the money is loaned to you in good faith due to your good credit rating. And in the event of an unfortunate default, the lender can sue you and place a lien on your other assets. It may take time, but the lenders will have the means to recover the money because you put your signature on the document that guarantees you will pay the loan terms.

Also Read: Earning From Cryptos in Your Spare Time – How Can You Approach?

How to Get This Type of Loan?

Secured and unsecured business loans are like filling out paperwork. However, the unsecured loan will not require you to put up collateral. Also, the approval rate for unsecured business loans is much faster than the standard rate. The main difference is how the lender reviews his credit history during the application process. You may be required to provide and submit proof of the following details:

credit score

No bankruptcy or other similar lawsuits

Number of years in the company

Annual income

proof of ownership

The requirement also sometimes depends on your relationship with the creditor. For example, you have a solid relationship with your banker, so you have established a relationship of trust. As a result, the bank feels more comfortable helping him overcome a shortfall because they know he has integrity and impeccable credit history.

Also Read: Amber Kinetics has the Kinetic Energy Storage Solution (KEES) of the Future

How to Submit Your Article?

Once your article meets our guidelines, you can send it to contact@newcomputerworld.com

Why Write For Us at NewComputerWorld– Unsecured Business Loans Write For Us

Unsecured Business Loans Write For Us

Loan

Business

Debt

Interest

secured loans,

collateral

accounts

balance sheet

business plan

credit unions

US Small Business Administration (SBA)

equity

credit rating

credit score

bankrupt

Search Terms for Unsecured Business Loans Write For Us

Write to us regarding Unsecured Business Loans

Write for us bankrupt

equity Write for us

Write for us outsourcing

Write for us balance sheet

US Small Business Administration (SBA) Write for us

Write for us Interest

Write for us balance sheet

business plan Write for us

Guest post

Contributor guidelines

Contributing writer

Guest blogging + “write for us.”

Write for us + guest blogging

Guest posting guidelines

Become a guest blogger

Become an author

Suggest a post

Submit post

Write for us accounts

Write for us Submit an article

collateral Write for us

Guest post

Looking for guest posts

Become a guest blogger

Guest posts loan

Guest posting guidelines

Become an author

Submit post

Suggest a post

Guest blogging + “write for us.”

Write for us + guest blogging

Technology write for us

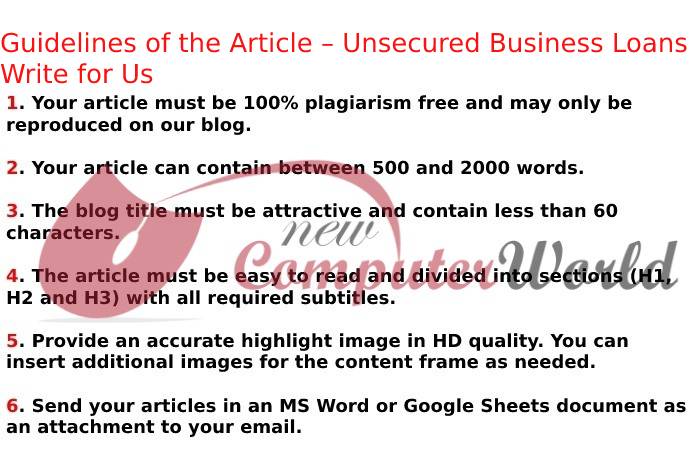

Guidelines of the Article – Unsecured Business Loans Write for Us

To Write for Us, you can email us at contact@newcomputerworld.com